Never grab good dealership’s claim that you have less than perfect credit within par value. You can perform a totally free credit file evaluate shortly after every year. Get the declaration, ensure that it is particular and look your suspicious interest. Bring your credit history along with you once you speak to prospective loan providers so you’re on an identical webpage after you explore your resource alternatives.

step 3. Research rates

“Don’t believe that just as you provides bad credit you cannot rating an auto loan,” Ulzheimer claims. In addition, “do not just believe that your borrowing is bad.” The concept of poor credit may not be similar to your lender’s definition, and you will lenders enjoys more criteria. Make sure you rating estimates out-of multiple loan providers you don’t help one take advantage of you.

Its a cruel paradox one to making an application for funds mode loan providers look at your credit score, and every hard pull-on your credit history has a small bad impact on your credit score. The good news is you to definitely rating activities usually count all the credit inquiry performed of the a car loan bank within this a two-week time as the an individual inquiry. Specific lenders also prequalify your for a financial loan with just a good soft remove, and therefore cannot apply to your credit score.

Due to this fact, it’s important to only complete a cards application for a car or truck loan whenever you are in fact ready to take you to definitely aside. Or even, your chance to make your credit rating problem bad.

5. Go for a shorter financing term

You might have down monthly payments which have a four-season in place of a around three-12 months mortgage, however, take note of the interest rate. Essentially, rates of interest try straight down to own brief-title fund, definition you have to pay smaller for the vehicle full. As well as, you have to pay off the car loan before, and that lets you run paying down other costs.

6. Get a hold of brand-new instead of old vehicle

Good judgment you’ll show an older automobile https://elitecashadvance.com/payday-loans-il/jacksonville/ costs shorter, you elderly vehicles usually incorporate higher interest rates than just new of these. Ulzheimer recommends to take on the trucks earliest then latest put vehicles – they are cars you to tend to have a knowledgeable capital choices.

eight. Get preapproved

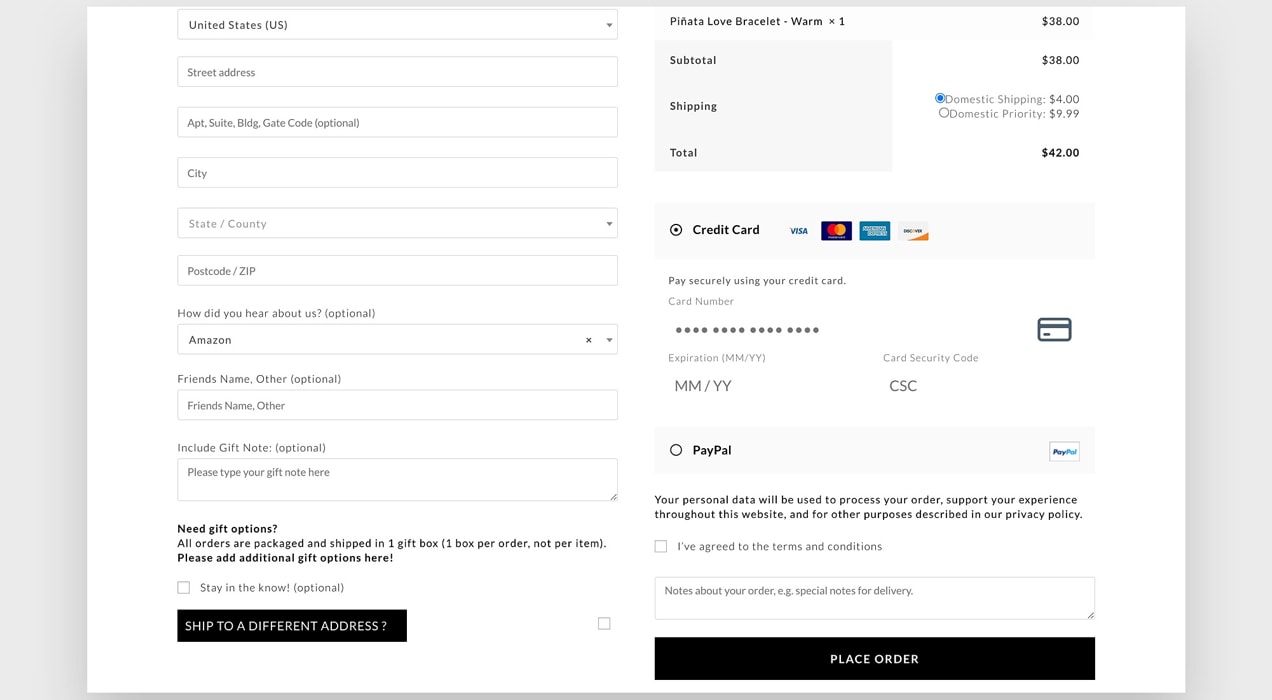

While it is not required, bringing preapproved for a financial loan on a financial or credit connection could help help make your vehicles lookup simpler. To locate preapproved, you fill out an inquiry or talk with a lender. The lender studies your income, credit rating or any other things to influence your own creditworthiness.

In the event that acknowledged, the financial institution lets you know just how much you might money, and will also be in a position to simply take preapproval documents and you may advice having your once you begin searching for a car. Understanding the preapproval matter makes it possible to stick to tune and in this budget when shopping.

8. Consider providing an excellent cosigner

According to your role, delivering a good cosigner was your best option to find an excellent financing from the a good interest. Consider searching for a great cosigner in the event that:

- Your income is lower compared to minimum need for a vehicle loan

- You have poor credit

- The debt-to-earnings proportion is just too higher in order to be eligible for financing

- You have a changeable earnings

Your cosigner is in charge of and work out your own payment per month for folks who can’t satisfy the loan debt, so only take this method if you are sure you could build your repayments in full and on day. Having fun with an effective cosigner allows you to power you to man or woman’s credit rating to help you get a better rate of interest otherwise financing terminology.

How dreadful borrowing impacts the car mortgage

As a whole, a credit score out-of 740 or more gets the lower interest rate on the a car loan. When you have best borrowing from the bank, you may be able to score a car loan while the lower because 0%. When you yourself have a woeful credit rating, you may be considering rates to 20% or more. Which can add up to expenses thousands of dollars a great deal more for a car loan that have poor credit instead of a good credit score.