It’s really no secret one to rates is rising. Shortly after experience checklist-lowest pricing inside the 2020 and you can 2021, they were bound to go back right up! So if you’re a customer (hint: we-all was) following such ascending interest rates usually connect with particular section of your own finances regarding short- and you can long-term future.

Why don’t we are priced between the beginning and you can talk about exactly what rates of interest is and you will the place you could possibly get come upon and you can/or perhaps be impacted by them. Next we are going to make you five steps you can take to greatly help include your financial health whenever rates of interest go up.

Exactly what and you can where try rates of interest?

Rates may be the commission amount owed toward a lent otherwise past-due harmony. These are generally expose for the consumer situations such as mortgages, college loans, credit card profile and much more. If you have borrowed currency otherwise is actually later inside the paying back currency, such as for instance a software application otherwise scientific expenses, it’s likely that you might be paying they straight back having focus.

Rates of interest also are contained in examining and savings accounts, Cds, and later years and you can using accounts. Consequently you might be getting more on such levels because attract cost rise.

Why should I care about interest rates?

You need to surely worry about rates of interest and is as to the reasons: it greatly connect with your own monthly finances, your small- and you will enough time-term needs, along with your latest and you can future to find strength.

While it is you’ll be able to to get a buyers and never provides to worry about rates (i.e., you will be debt free), nearly 80% out-of Us citizens come into personal debt on the average private keeping $155,100 in financial trouble. This is from mortgage loans, car and truck loans, student education loans and more. If you are among 80%, you need to be familiar with interest levels for the all your valuable profile.

Just how would be the interest rates selected my personal account?

Short answer: your credit score. Much time answer: your interest rates are established centered on your current credit rating, your credit history, your revenue and you may capability to pay back, promotional APRs, financing companies, finance companies, the Government Put aside and a lot more. You have got varying and you will fixed speed rates of interest in your more accounts.

Currently, we are much more worried about changeable prices. Eg, which have varying price things such as playing cards, you ericans) however they are now enjoying it increase in order to 19% or more. Thus as you don’t always use extra money, you’ll end up investing extra money within the focus. And because it is a variable price, you will possibly not recognize how large the speed will go or when/whether it tend to plateau. Due to this, for many who hold credit debt, rates of interest are very important on payment bundle.

To determine about how exactly your own interest is determined to the any profile, contact your bank otherwise upkeep team.

Are you aware? Government education loan interest rates was a predetermined speed and are generally put by Congress for each spring. These include scheduled to evolve that it slip out-of 3.73% so you can cuatro.99% for everybody the fresh new consumers. For additional information on student loan interest levels, speak to your carrier.

Five steps you can take when interest levels rise

We’re glad your asked! Preparation is key to your own proceeded monetary victory and since desire rates was projected to carry on to increase throughout the 2022 and you can beyond, it is essential to keeps a plan.

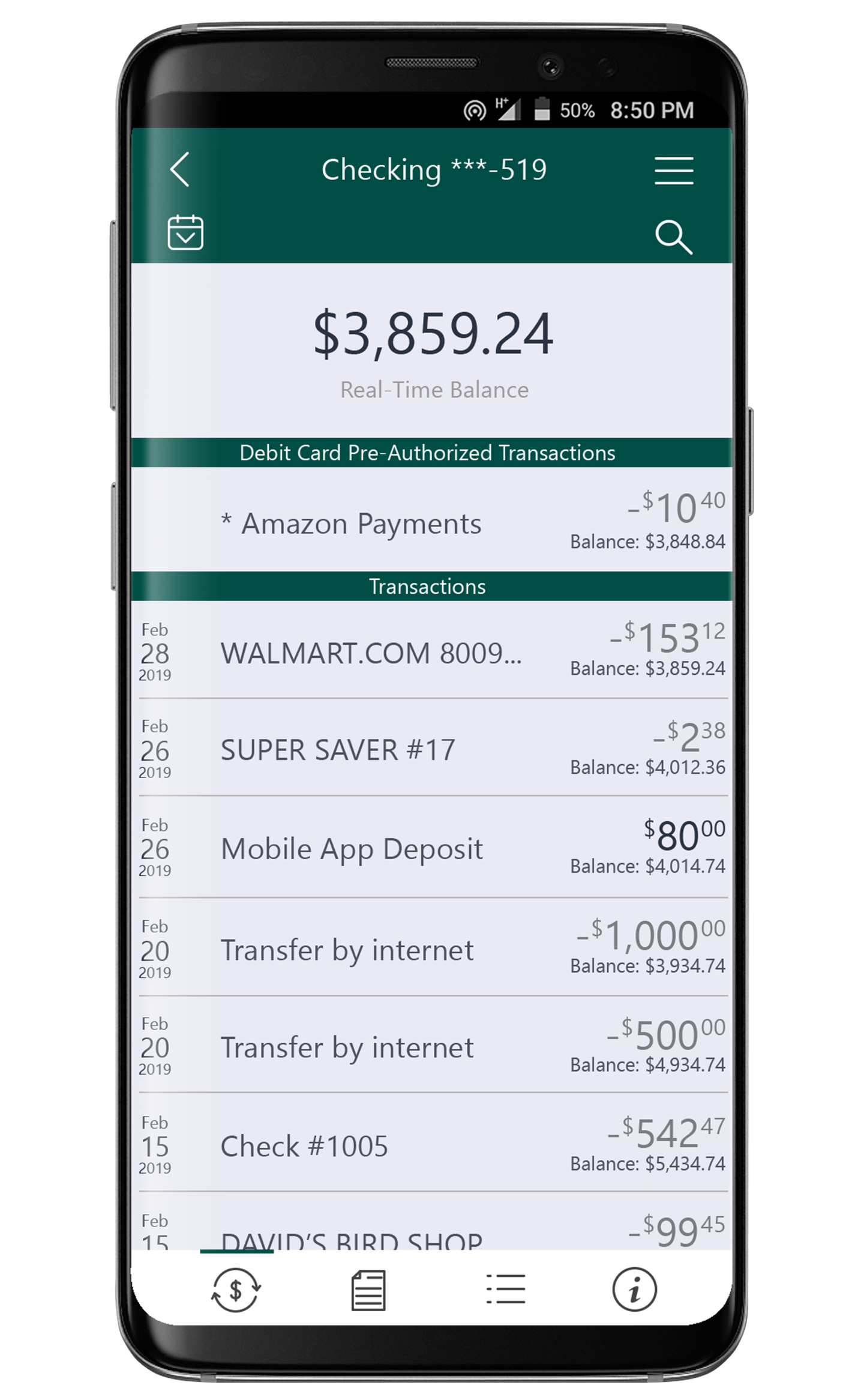

step 1. To alter your finances. When you have personal debt with changeable interest levels instance borrowing from the bank notes otherwise figuratively speaking not belonging to the federal government, you will notice the prices increase and your monthly minimal money. Look through the past several months of the statements to see what you’ve been paying as well as the interest levels. Has actually they improved this year? Because of the simply loan places Stepney how much? In this case, the most basic and you may quickest thing you can do is always to circulate fund to on the budget to match such speed change and higher monthly premiums. As an instance, if you shell out more than monthly minimums with the fixed rates debts such as for instance mortgages, contemplate using you to even more to greatly help pay down your changeable speed expense. Otherwise, it could be time to slashed other places of one’s funds for now.

dos. Consolidate financial obligation. Consolidated debt might be the ideal choice if you are holding mastercard stability towards more than one credit otherwise have numerous student education loans, such as for example. Of the merging debt, you might be generally moving every thing to just one place and you can purchasing you to payment that have you to rate of interest. This will help you spend less instantaneously, pay down expenses quicker, which help one to be more arranged along with your earnings.

Envision a balance import out of personal credit card debt to help you a cards which have a lesser rate, or better yet, combine credit card debt toward a consumer loan from the a city lender that have a predetermined speed.

step three. Refinance. For the moment, we had suggest just refinancing debt who’s got a changeable price (credit cards, private student loans) into the that loan who has got a predetermined rate. If you do this, look for changing conditions with your the latest servicer. This might include a changed name length, highest payment, or any other essential facts.

Also keep in mind it is preferred from inside the a great refinancing state having a smaller-identity length in order to shell out a lot more monthly but spend smaller through the years. This is the purpose!

cuatro. Continue rescuing. Continuously preserving-and perhaps rescuing even more if you are in a position-will help reduce credit card debt and other expenses, it can also help you to definitely generate an urgent situation finance, create your old age and you can expenses account, otherwise coupons profile. We constantly prompt all of our players to keep up to it is also, although it generally does not appear to be a lot at that time. In fact, if you’re saving cash into the a money business account, you are going to take advantage of this type of increasing rates!

Including, for those who have a beneficial Cd (certificate regarding put), envision animated money for the a funds business membership. You can learn about one inside our blog site to the switching markets. [enter link:

5. Work at your credit score. Working on your credit rating was a slow, years-long procedure. The small actions you will do every single day such make ends meet for the time and continue utilize lower, impression your credit rating. Understand a guide to your credit score, discover our very own writings Ways to get Smart Regarding the Borrowing.

By using the hands-on strategies you can easily in order to slowly raise your credit score, you might be form oneself doing become a the+ debtor that enables the finest interest levels and you may terms with loan providers. It saves your money towards the many techniques from the mastercard profile to refinancing your own financial and now have will give you a much better chance at becoming recognized to other money and you will individual things.

The new growing rates this season are not strange. Cost rise, markets changes, and you can economies vary. These are most of the section of using once the a customer being financially separate.

Although it’s true that people cannot physically control the attention cost, we are able to control how we prepare for and you may react to exactly how those individuals modifying prices might connect with us. The greater you are familiar with all of your current membership and you may using models, more it is possible to make advised conclusion and you will plan any concerns afterwards. It might take discipline and patience, but it’s worth it and you will exercise!